Token Distribution

Overview

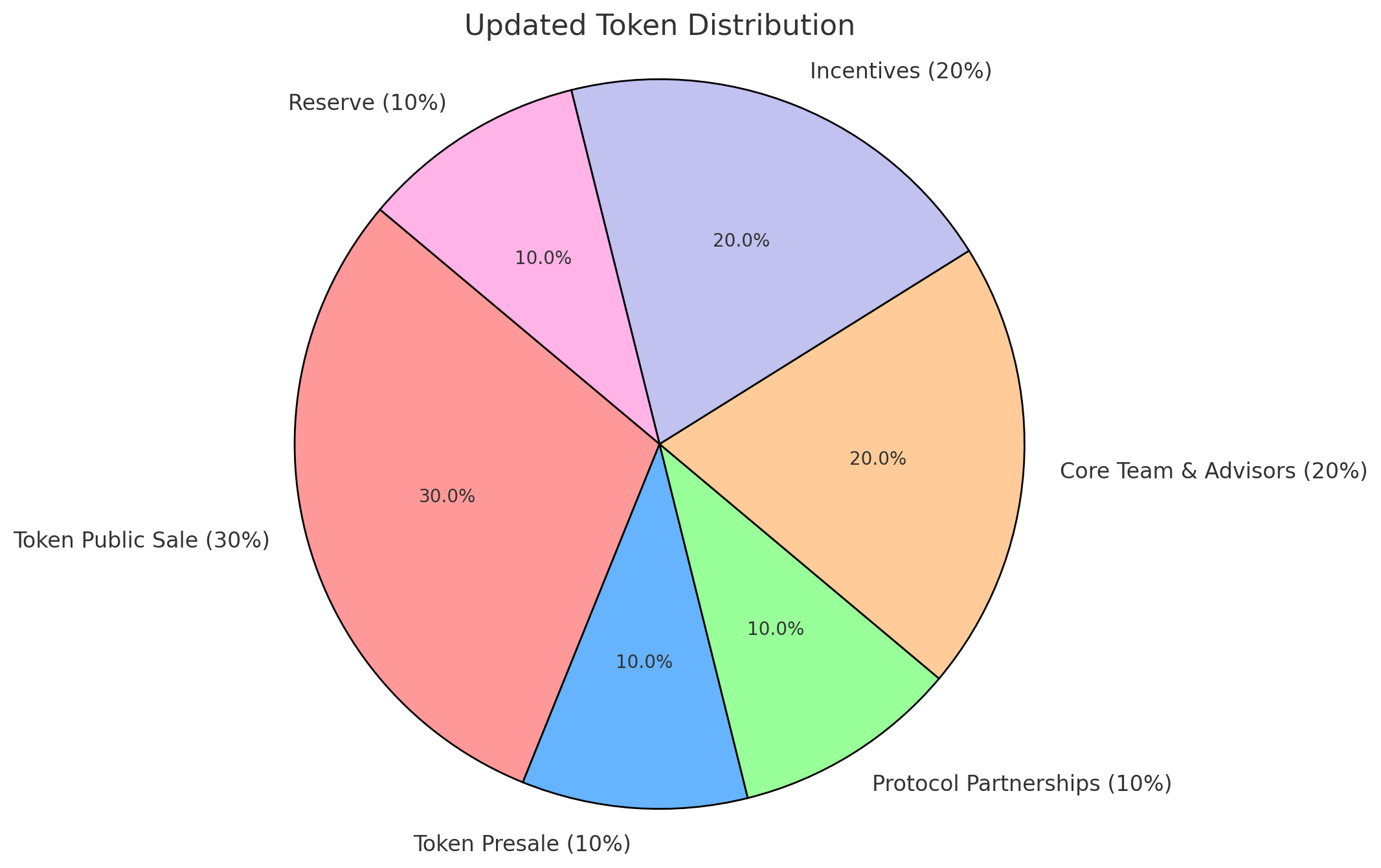

The Tapir token (TPR) is distributed across six categories to balance liquidity, growth, and long-term alignment.

Allocation Details

Category

Allocation

Lockup/Vesting

Purpose

Token Public Sale

30%

Immediate unlock

Open sales to the public via platforms (e.g., exchanges, launchpads).

Token Presale

10%

Locked (terms vary)

Early investor access with tailored lockups to prevent market flooding.

Protocol Partnerships

10%

2-year linear vest

Strategic partners receive tokens to ensure commitment and collaboration.

Core Team & Advisors

20%

1-year cliff + 1-year linear

Align team incentives with protocol success.

Incentives

20%

1-year lock

Rewards for liquidity providers, stakers, and early contributors.

Reserve

10%

Treasury-held

Emergency funds, strategic initiatives, or future protocol upgrades.

Pie Chart Visualization

Technical Implementation

Public/Presale: Tokens minted upon purchase and transferred to buyer wallets.

Partnerships/Team: Tokens held in escrow with vesting logic enforced by timelock contracts.

Incentives: Rewards distributed via claimable contracts with built-in lockups.

Last updated